When it gets crazy in the real estate market it pays to have a look at what the data is doing.

CoreLogic captures data and they are a great source for tracking what is really going on in the residential market places across Australia.

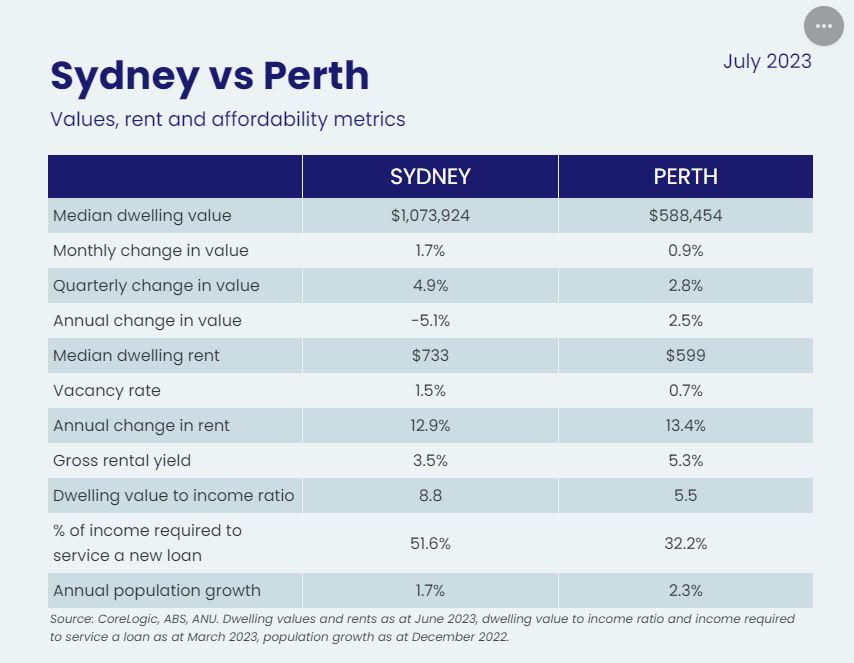

There is so much to take away from this graphic.

In particular I want to focus on the % of income required to service a new loan.

32.2% in Perth vs 51.6% in Sydney.

This is a clear indication that Perth has more capacity to ride the rate rises, unlike Sydney (and Melbourne).

If the rate cycle is coming to its zenith, and ultimately flattens off, WA could indeed emerge Houdini-like.

We will likely still be digging holes for the world’s electric cars and China’s insatiable appetite for iron ore.

With effective full employment and annual population growth running at 2.3% (higher than Sydney), a 42 year record low shortage of rental properties (0.7% vacancy rate) and this week there are a historically ridiculously low 3,799 houses and apartments for sale (in a city of over 2,100,000 people!). The median selling times for houses are tracking unsurprisingly at a record low of 10 days for June and July of this year.

The weakness in this conversation is the iron ore price. At around 30% of the GDP for Western Australia, this is a significant factor. If in the future it dips enough, then the steady population growth that Perth is known for will slow and the demand for housing may ease.

The future upside is the global demand for battery material with Nickel and Lithium being predicated to be in high demand for years to come. Western Australia stands to capitalise handsomely.

Perth remains the second best value proposition for buying a home out of all the capitals (Darwin is the current exception). Unsurprisingly our population growth is driven by interstate migration, as people depart the Eastern seaboard in search of lifestyle and value.

I’ve polished my crystal ball and it says that Perth residential median prices are more likely to keep increasing, than any other outcome in the medium term.

Derek Baston