What is the outlook for Perth’s residential property market?

Buyers are competing for limited housing supply forcing prices up with property pundits suggesting 20% growth for Perth metro over the course of the year.

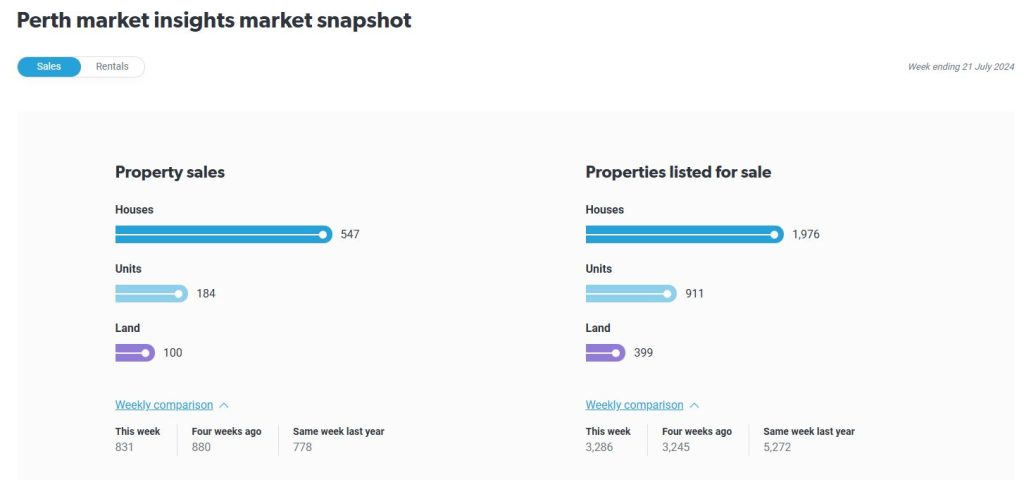

Stock levels remain ridiculously low !

(data courtesy of REIWA)

Many suburbs of Perth have already seen 20% plus growth over the last 12 months, with East Victoria Park house prices having jumped 24% to a new record median of $926,000.

As the market steams ahead we are all on the lookout for market headwinds.

What changes the market direction?

A drop in iron ore prices.

Upward interest rate movement.

Cost of living and inflation pressure.

Unemployment increases.

And what is holding the ship steady, pushing inexorable forward with every increasing price?

Housing supply shortages.

Labour shortages.

Increasing wages.

Availability of money.

Steady or decreasing interest rates.

New mining projects

There are very few dissenting voices.

The property brainstrust of economists and banks are saying the Perth market still has legs.

The gap on affordability between Perth and East coast capitals is still vast.

(I remember a time in 2006 when the median price for a house in Perth was the same as Sydney.)

The July 2024 median days for selling is down to just 8 days, meaning the sentiment in Perth is still incredibly property positive.

The next bit of the property cycle, characterised by an affordability crisis, oversupply of houses and decreasing construction costs seems so very far away.

With the mining cycle in full swing, civil construction in Perth at an all time high (think Metronet) and average Australian salaries topping $90,000 per annum there is still time left in this bit of our residential market.

In discretionary parts of the market (boats and classic cars) there has been some cooling. But this sort of spending is a long way from the necessity of putting a roof over your head.

With price growth predictions for Perth continuing into 2025 and beyond, it seems there is little of local origin that can head off the upward price trajectory of this very livable West coast city.

For a considered opinion on all things residential real estate and how best to maximize your sale price, organise your appraisal here.

Derek Baston

0417 99 23 24

sales@bastonandco.com