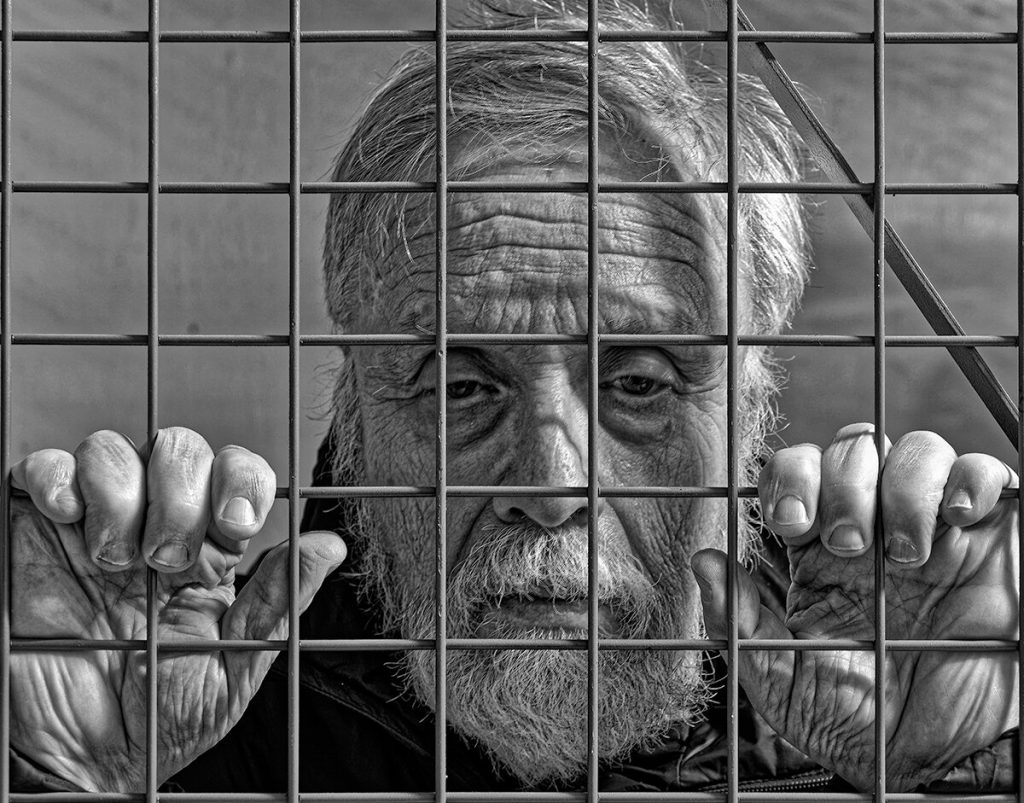

Today as I appraised a western suburbs home worth in excess of 2 million dollars, the elderly owners lamented that they were trapped.

As they explained, to buy a home they needed the cash from their existing property.

But of course an offer subject to their sale wasn’t getting any traction in the market, as pre-approved subject to finance and cash offers were trumping their efforts.

So off to the bank they had gone cap in hand chasing a bridging loan.

5 years ago this was a lay-down misere, but new federally imposed responsible lending practices mean it’s a hard NO from the banks.

Nevermind that the median time to sell a house is 8 days in Perth and there are less than 2,000 houses for sale at present!

The bank’s hands are tied, they simply aren’t allowed to provide the common sense good business solution for all parties involved.

So asset rich and without cash flow to facilitate a loan, this retired couple are stuck in a home that does not meet their needs.

With too many bedrooms, on too big a block, this is just another example of how Perth’s housing needs are not being met.

There is a family crying out for this home, being told weekend in weekend out, there is nothing on the market.

Potential Sellers are bound up in an intractable morass, without a solution in sight.

Down-sizing should be possible.

Forget stamp duty for relief for this demographic, they just want a mechanism so they can go shopping for a new home, then sell their old home.

The non-bank lenders have started to fill the breach, at a price.

This is a double edged sword.

They provide a solution, but in an RBA Bulletin in March last year this less than heavily regulated financial space warranted a warning, “..the rapid growth in housing lending by non-banks, and data limitations over the full scope of non-bank financing activity, call for ongoing vigilance by regulators and policymakers.”

We may lack sympathy for those homeowners stuck in their gilded cages, but the solutions to this housing crisis (on the supply side) are not going to be solved by building new homes alone.

It also has to be aided by swift-footed reaction, adjusting regulatory settings, and in this case lending criteria to meet the changing needs of the market.

These older homeowners shouldn’t be forced outside of mainstream (safer) lending corridors just to do what we would all hope they do – sell and release their family home to the market!

Derek Baston

0417 99 23 24