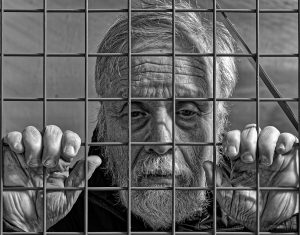

Flying The Coop

A practical post on a First Home Buyer’s journey to buy in a very buoyant market.

Ok this is a long post, but if you or somebody you know wants to get a sense of the first home buyer journey, beginning to end, it should demystify the process just a little.

It should also provide some hope that housing is not unobtainable in Perth even for our youngest homebuyers.

Normally I am almost always on the Seller side of the equation (it’s an occupational hazard being a real estate sales person!).

Recently I had the opportunity to go on the journey from the perspective of a first home buyer.

My 20 year old daughter, Anais.

Anais has been living in the Granny Flat at home in the backyard, paying board every Sunday for the past 2 years.

It’s a sweet deal.

$150 per week – she gets a roof over her head, food and all the internet she can consume.

A year and a half ago she started a job on the Terrace for a big law firm in an administrative role. She has saved (from a Father’s perspective, probably not as hard as she could have) a nest egg and started tracking the real estate market.

She was intent on getting into the market.

So what could she afford?

First step: talk to a Broker.

She did this and came up with two numbers.

She could afford up to $305,000 if she moved in straight away, or she could afford up to $340,000 if the property was tenanted (this increases the loan serviceability amount for the purposes of calculating the maximum loan amount)

A $305,000 buy price and moving in straight away meant she would be classed as a first home buyer and not have to pay stamp duty (First Home Buyer Stamp Duty exemption in WA for purchases under $430,000).

A $340,000 buy price meant she would have to pay stamp duty (approx $11,000), but once the current tenant vacates, and she moves in, she would then be able to claim that back from the Office of State Revenue.

As cash flow was tight the decision was made to look at newer buildings (around 10 years old) in the area where she currently lives (Victoria Park / East Victoria Park).

Newer buildings mean a higher buy price, but hopefully less surprises with strata costs over time.

She also chose to buy into a building without facilities (pool, gym, etc) to again keep a lid on potential strata costs for facilities she may not use.

I will not lie.

She looked at a lot of places!

The perfect property always seemed out of reach.

It was a continual education, but it narrowed her focus and she made some compromises to make buying a first home a possibility.

So with all this in mind Anais found a large one bedroom tenanted apartment with a generous north west facing balcony in a 10 year old building on the Albany Highway cafe strip in East Victoria Park.

She eventually purchased the apartment for $345,000.

How was this possible you ask?

Well she used part of her savings, to cover the additional purchase cost ($5000) and part of her savings to pay the Stamp Duty to the Office of State Revenue.

There are some workarounds to avoid paying LMI (which can be many thousands of dollars).

Yes, she had a short-fall on the deposit amount the Bank required (they require a deposit amount of 20% of the purchase price).

Usually this means a buyer has to take out Lender’s Mortgage Insurance (LMI) to cover the bank’s risk.

It’s a weird concept – you don’t have enough money, so to fix that problem you must pay more money!

- Government guarantees for first home buyers. Unfortunately not everyone qualifies. There are quite stringent tests and the number offered is limited each year.

- Anyone else as Guarantor.

Anais went with option 2.

Her parents (us!) underwrote 20% of the loan value.

This means if Anais couldn’t pay her mortgage, and the bank forced a sale to get their money back, and there was a shortfall to cover their debt, then they would chase us for the money.

Now we are just a few short days from settlement.

Anais has completed her Final Inspection to ensure the property is as originally inspected and plumbing and electrical items are in working order.

She has appointed a Property Manager to collect the rent and manage the tenancy vacate later this year.

It has been a journey with plenty of new concepts and learning (for all involved!).

I am very proud of her commitment to this goal and sincerely believe that it will be the cornerstone to a lifetime of housing security.

Derek Baston

0417 99 23 24

sales@bastonandco.com

RatemyAgent 2023 Agent of the Year Victoria Park