It’s a federal election and it’s tempting to write a tome in response to the noise that the political parties are making.

But in these times of electoral verbosity and media messages on repeat I would hate to add my political voice to the mess that charades as electioneering.

I feel I can at least comment on a policy relating to residential real estate that the major parties have “agreed” on.

Whoever holds the reins of power has committed to underwriting the home loans of a percentage of first home buyers who qualify by having a suitably low income. In a nutshell the policy will allow a 5% deposit – down from 20%, and the government will go guarantor.

This seductive policy is exciting for those young people denied an immediate opportunity to participate in the great Aussie dream of home ownership.

So what could it mean? Well it brings forward demand in a small portion of the market. It is likely, for this niche of affordable homes, with increased demand driven by government policy, that the prices will go up more than 5%. The benefit of the policy immediately flowing to the sellers.

Even worse, these battling younger buyers will commit to a bigger home loan than if they had saved a bigger deposit. So what you say? Well a bigger loan equals more interest paid over the life of the loan.

This policy is a win for the banks. It de-risks their loan book, increases the size of these loans and makes them more money.

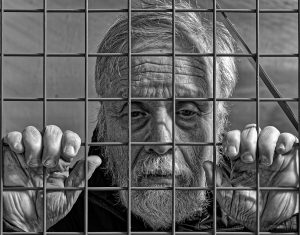

If a buyer can’t afford to be in the market, (this next bit is controversial) well maybe they shouldn’t be buying a house? We are taking the most vulnerable and unsophisticated buyers and shoehorning them into a place where perhaps they don’t belong.

Currently in WA we are seeing the direct and disastrous results of this type of government lever pulling. On the periphery of Perth defaults rates are high and negative equity is the reality. Many of these first time buyers were induced into the market with sweetheart deals of $15,000 – $10,000 first home buyer grants, $0 stamp duty and easy lending conditions.

Fiddling around in the marketplace because it buys votes will end in tears.

Derek Baston