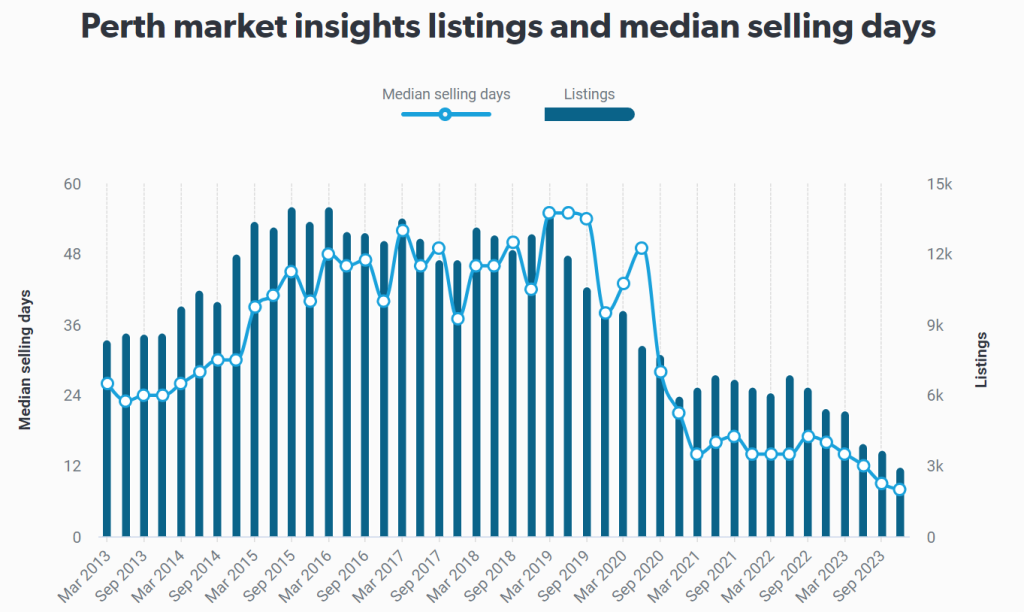

Perth metro stock levels are under 3,000 listings and median selling time is 8 days (source REIWA December 2023).

These are ridiculously low numbers.

From a high of over 14,000 listings in September 2019 to December’s low of 2,969, the Perth market has become a powder keg. The fuse is lit and something is about to blow.

With the median house price increasing from $481,000 in 2019 to $587,000 in 2023 we have already seen more than a 22% increase. You may have seen reported that some market pundits say Perth has run its race.

I’m here to say that the fundamentals support the exact opposite.

With the end of the interest rate cycle potentially in sight as inflation comes within the RBA target range, and no way to increase the supply of housing in a meaningful way, the upward pressure on housing values that already exists will intensify even more.

Western Australia particularly, continues to enjoy/suffer from a mining super-cycle.

Mining is a significant contributing factor to the influx of people to the State over the last year (approximately 70,000), a significant factor in the State’s low unemployment rate and high median wage (December ABS data had Ashburton in the State’s north with the Australia’s highest median wage at $105,655, significantly more than the national average of $56,547).

So what does this all mean for you?

If you are buying, be aggressive. Avoid missing out, and have confidence that the market has legs, with future growth a likely reality.

If you are selling, have a strategy.

There is scarcity and good quality, well-presented homes will reward owners who put the effort in.

BUT it is important to note the market quirks.

In the inner city, the market is driven almost solely by owner occupier buyers.

In the outer suburbs, the East Coast Mum and Dad investors and their Buyer Agents are still very active (chasing rental yield in an equally crazy rental market).

Land is still the slowest moving part of the market.

Anecdotally we are seeing land enquiry increasing, as smart money moves to the opportunity. It is becoming easier to build every day, and higher sale prices for established homes are starting to support the current higher build costs. If you have been sitting on land, or a development block the market is improving daily.

Units are finally on the move, with 6.5% growth over the last 4 years. Interestingly they show no real growth for the last 12 months. Without forensically examining the data my read is that with Perth’s median rent at $600 per week, good value apartments are now flying off the shelf – as it is now cheaper to buy than rent, in many cases. It’s not that the value of apartments isn’t increasing, it’s just that more cheap apartments are selling, hence lowering the median sale price. With the lack of affordable replacement apartment stock into the foreseeable future, due to the lack of new builds at this price point, it stands to reason that apartments remain good buying (all the normal caveats apply here – must be a well run complex with the future maintenance costs of the building well managed by the existing owners).

None of this constitutes advice, and you are all aware I do not possess a crystal ball. It is just my view of the Perth residential market.

It’s going to be a cracker of a year. Strap in for the ride!

If you have a house in the Perth metro area and you are thinking about selling, get in touch with me to talk about maximizing value.

Derek Baston

Baston and Co.

0417 99 23 24